Charts explaining the Productivity Paradox, which refers to the slowdown in productivity growth despite achievements in Computer Science

All in Finance

Portfolio Rebalancing Spreadsheet

Use this spreadsheet to rebalance your portfolio and assess your asset allocation. The spreadsheet leverages Google Sheets and contains sample data.

Opportunistic Order

An Opportunistic Order is an opportunistic means of buying low and selling high during a given time frame.

Estate Tax

The Estate Tax is a tax on property transferred upon one's death.

Window Dressing

Window Dressing is the unscrupulous practice of trading securities merely to improve the appearance of a portfolio for quarter end reporting.

Santa Claus Rally

A Santa Claus Rally is a rise in stock prices between Christmas and New Year's Day.

Crude Oil

Crude oil is the raw oil obtained from drilling and its price is affected by supply & demand as well as the strength of the US dollar.

Beige Book

Summary of Commentary on Current Economic Conditions by Federal Reserve District

Fee-only Financial Advisor

A Fee-only Advisor avoids conflicts of interest by refusing "kickbacks" on the investments, products, or services that he/she recommends.

Earnings per Share

Earnings per Share (EPS) is a popular but flawed measure of a company's profitability.

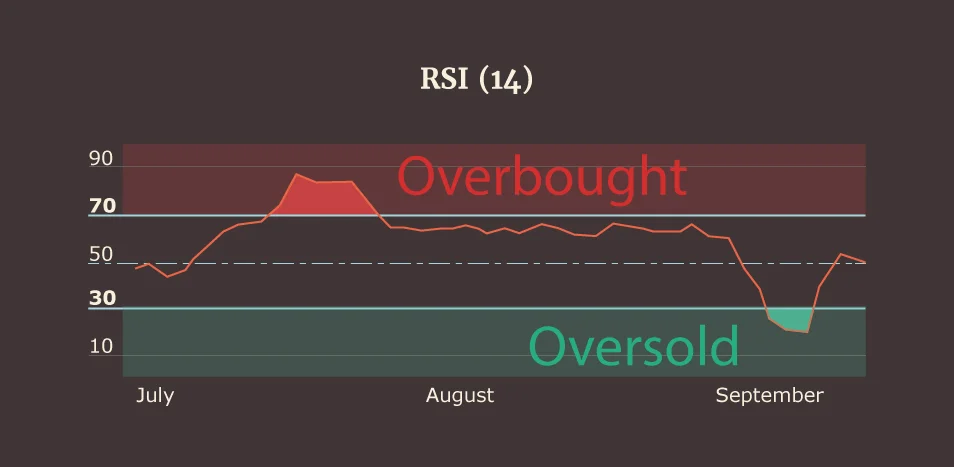

Relative Strength Index

The Relative Strength Index (RSI) attempts to identify overbought and oversold scenarios.

Individual Retirement Account

An Individual Retirement Account (IRA) is a tax-advantaged account for retirement savings.

Inflation

Inflation is the loss of purchasing power as a result of too many dollars chasing a limited supply of goods and services.

Market Timing is an investment strategy where an investor buys or sells an asset based on a predictive assessment of that asset's price movement.

Time Horizon is the duration that an investor expects to hold an asset or portfolio before taking distributions from that asset or portfolio.

Consumer Debt is a liability incurred on an item that does not appreciate (e.g. Credit card debt).

Buy-and-Hold

Buy-and-hold is an investment strategy where an investor buys an asset and holds it, irrespective of price fluctuations.

Technical Analysis is a method of analyzing securities to make investment decisions based on historic market data and trends.

Value Investing is an investment strategy, for which investors like to buy near book value, at low valuation ratios, and high dividend yields.

Net Worth = Assets - Liabilities. Assets include things like checking and IRA accounts. Liabilities include things like credit cards and mortgages.